Explain the Different Types of Financial Institutions

There are various types of banks like commercial banks community banks investment banks retail banks etc. The most common types of financial institutions are commercial banks investment banks insurance companies and brokerage firms.

Types of Financial Instruments.

. Find a Dedicated Financial Advisor Now. Here are some of the basics about community banks credit unions international banks and online. Types of Financial Institutions Investment Banks Commercial Banks Internet Banks Retail Banking Insurance companies Mortgage companies.

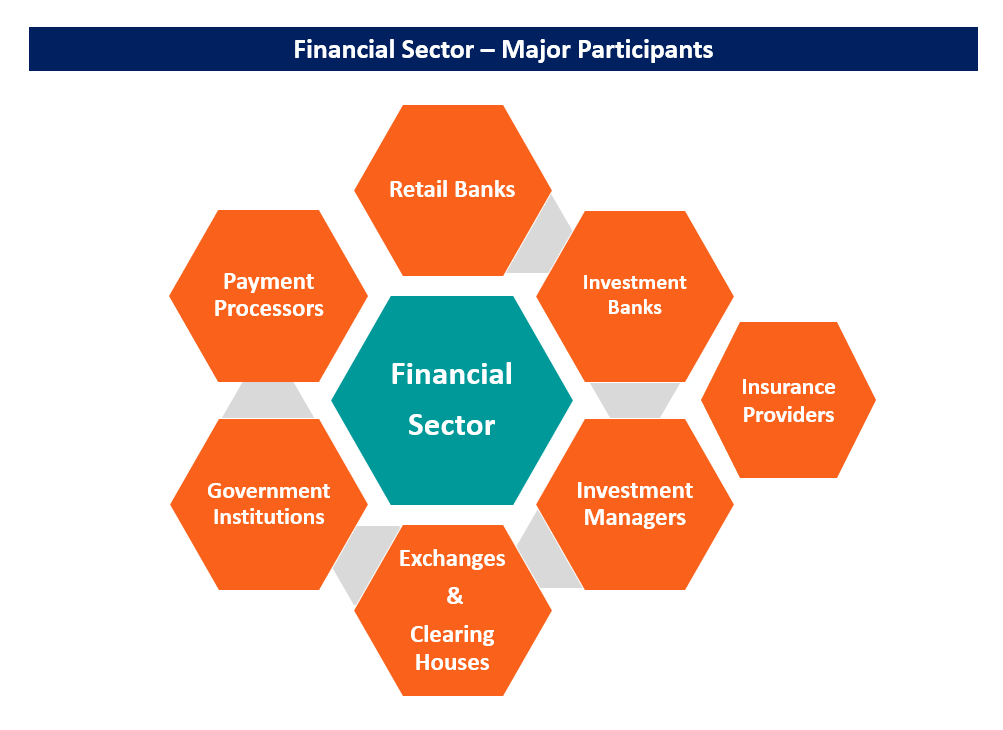

Ad Do Your Investments Align with Your Goals. Identify the different types of financial markets and financial institutions and explain how these markets and institutions enhance capital allocation. Commercial Banks Banking Investment Banks Wealth management Insurance Companies Insurance Brokerage Firms Advisory Planning Firms Wealth management Advisory CPA.

Within cash instruments there. Explain how the stock market operates. Types of Financial Institutions Commercial Banking.

Life Is For Living. Find A Dedicated Financial Advisor. Financial institutions serve as financial intermediaries between savers and borrowers and direct the flow of funds between the two groups.

So lets dive into understanding the 4 common types of banking institutions. Insurance companies give protection against financial losses. Financial intermediaries are highly specialized and they connect market participants with each other.

Depository financial institutions take deposits from customers while non-depository financial institutions will provide financial services without accepting deposits. Several different types of financial institutions focus on investing activities for individuals and businesses. Financial intermediaries include banks investment banks credit unions insurance.

The World Bank the International Monetary Fund. Commercial banks provide administrations services such as making business advances offering. A Taxonomy of Financial Institutions Services and Risks.

International financial institutions IFI are organizations that were created by national governments from different nations. Subdividing risk-mitigation strategies into the three categories ie avoidance transference and active firm. These include private lenders mortgage companies loan.

Those that accept deposits. Cash instruments are financial instruments with values directly influenced by the condition of the markets. Lets Partner Through All Of It.

Financial Sector Overview Types Of Financial Institutions

People Always Ask What Is The Difference Between A Bank And A Credit Union Check Out The Chart For Some Answ Credit Union Financial Institutions Union Bank

What Is A Bank And Different Types Of Banks In 2022 Financial Management Bank Financial Retail Banking

0 Response to "Explain the Different Types of Financial Institutions"

Post a Comment